Not only can you create your own schedules, but you can often choose your assignments instead of being at the beck and call of a demanding boss.

Nevertheless, working from home comes with perks that you can’t get on the payroll.

Still, it’s not something to jump into lightly. Before you give up your day job you must ask yourself not just whether a freelancing career is right for you but whether you’re right for freelancing.

Starting out as your own boss

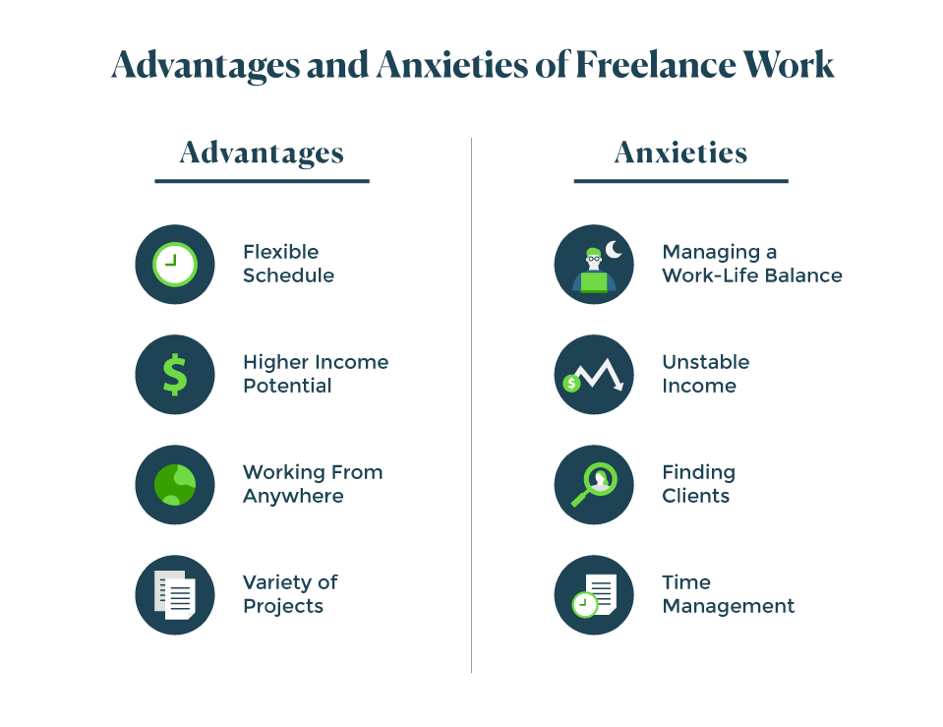

To start with it’s worth weighing up all the pros and cons to decide if freelancing is right for you. For example, if you get a good set of benefits in your current job, would you miss these if you quit? Could you fund them (if you needed to) from your wages?

If you decide to make the leap, contacts are key. Shouting about the fact you’re going freelance before you’ve actually done it means more people will know you’re available and look to hire you if they need someone.

Networks such as LinkedIn, Twitter, and Facebook play a part here in linking you up with potential Kiwi jobs and employers. Online groups can also be a great place to talk to fellow freelancers about everything from what price to charge to how to chase a late payment.

It’s also a good idea to have some savings behind you before you jump. When you start you may not be paid straight away. Having a pot set aside to cover your regular monthly outgoings is a good idea.

If you can stick it in a separate savings account, this can provide a good buffer if there’s a gap between securing your first job and getting paid. This can be helpful down the line if you’re ever short of work and need to pay out for other financial commitments, such as childcare costs or a mortgage.

Tax in New Zealand is taxing but it doesn’t have to be. Check out our comparison of the best kiwi accounting software. Almost all offer a FREE trial, so worth shopping around and find the best one for you and your business.

Tax is another issue. You need to let IRD know that you’re going it alone and then pay tax on anything you earn above your personal tax allowance. There’s also a range of business expenses you won’t need to pay tax on, such as travel or clothes used for your work.

The most common way to do this is to be either a “sole trader” or a “limited company”.

Check out IRD’s website for more information on being self employed or starting a limited company.

You could also pay an accountant to help you with your taxes. Weigh up the pros and cons of doing this, and any costs involved, before you sign on the dotted line. In some circumstances, you may be confident doing your taxes on your own and keeping all the money you’ve earned. But if an accountant can help you to save money, it might be worth it.

3 things to do right now…

Make a list of pros and cons to decide if it’s right for you. Ask questions of fellow freelancers and potential employers to find out how much work is available, what you might earn, and how much you would have for your savings. Weigh this against your current situation.

Write your business plan, including how much you need to earn to cover all your costs (don’t forget pension savings and sick pay), what skills you may need to improve upon and the costs involved, how many hours a week you’ll need to work, where you’re going to work, what equipment you might need, and how you’re going to manage any unforeseen costs that come up.

Tell IRD when you go freelance and start managing your money and taxes straight away. There are lots of apps to help with this if you don’t want to spend hours trawling through spreadsheets and receipts.

If you’re looking for a Kiwi business loan, check out our comparisons here.